SK Hynix and Samsung to Abandon Chinese EDA

Advertisements

In recent developments within the semiconductor industry, SK Hynix, one of the leading memory chip manufacturers, has taken proactive steps by initiating a review of the semiconductor Electronic Design Automation (EDA) tools provided by Chinese suppliers. This measure aims to mitigate the potential impacts of new U.S. policies that could restrict Korean semiconductor companies from utilizing Chinese EDA tools, especially under the new U.S. administration. The urgency of this review indicates a significant shift in the industry, driven by geopolitical tensions and market dynamics.

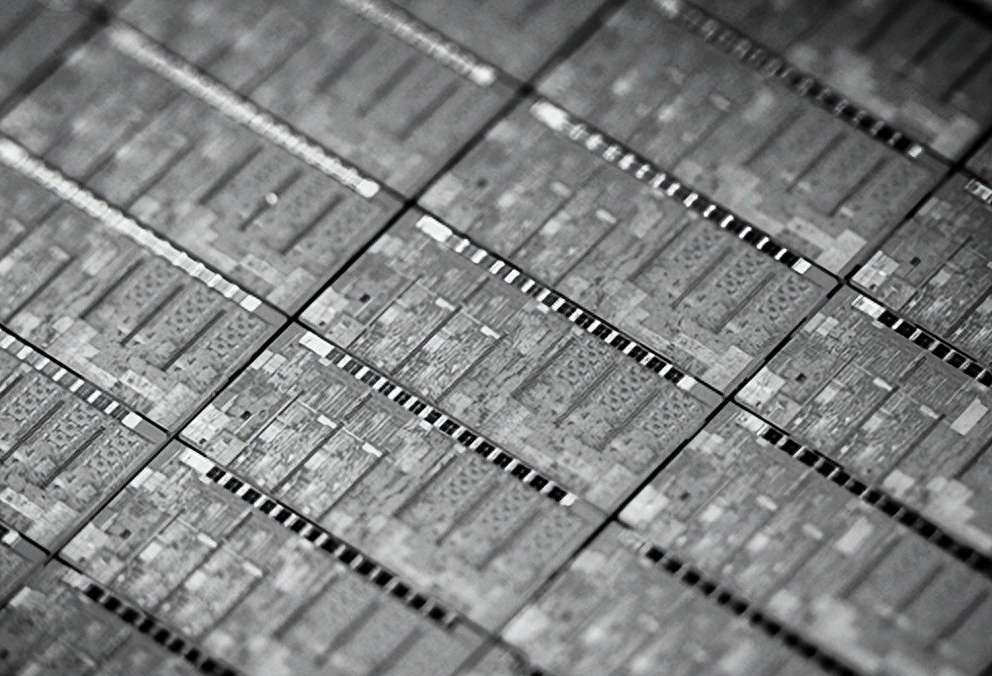

Electronic Design Automation is often referred to as the "mother of chip design," serving as an indispensable tool within the semiconductor supply chain. As the integrated circuit industry continues to evolve, the complexities of circuit design and fabrication processes have escalated, necessitating the reliance on sophisticated EDA tools. These tools help designers conduct circuit design, layout design, layout verification, and performance analysis, significantly reducing design flaws, enhancing yield rates, and saving costs associated with physical chip fabrication.

According to research firm TrendForce, key U.S. companies such as Synopsys, Cadence, and Siemens hold substantial shares in the global EDA market, combining to control approximately 74% of the market. Specifically, Synopsys leads with a 32% share, followed closely by Cadence at 29%, and Siemens at 13%. This dominance underscores the challenges faced by non-U.S. EDA providers, particularly in the current environment of U.S.-China competition in technology.

In response to this competition, China has accelerated its push for domestic EDA solutions, with local companies increasingly adopting homegrown EDA tools. Prominent Chinese EDA firms include Empyrean (formerly known as Huada Jiutian), Primarius (which acquired Entasys), and Semitronix, among others. These companies have made significant strides in developing EDA capabilities, illustrating China's commitment to achieve technological independence in the semiconductor space.

The market presence of domestic EDA providers in China has been growing, but it still trails behind that of their U.S. counterparts. In 2020, the market share of Chinese EDA vendors was only 11.5%, with Empyrean leading the local space by clinching about 6% of the market. Historically, companies like Samsung and SK Hynix have primarily relied on tools from major U.S. suppliers, but in recent years, they've started to incorporate EDA products from Chinese vendors due to improvements in performance and cost efficiency.

Interestingly, the relationship between Chinese EDA companies and major Korean chipmakers has intensified as restrictions on U.S. exports to China have increased. SK Hynix's scrutiny of its usage of Chinese EDA tools not only protects its interests but is also reflective of the potential for the escalation of U.S. trade policies aimed at the Chinese semiconductor sector.

There are insinuations in the industry that SK Hynix may entirely stop using Chinese EDA tools to avoid complicating its relationship with U.S. regulators. This situation has been compounded by earlier trade restrictions imposed by the U.S. on Empyrean's Korean subsidiary, which has prompted a review of the risk associated with collaboration with Chinese EDA companies.

Notably, the acquisition of Entasys by Primarius in mid-2021 for approximately $8 million highlighted the ongoing consolidation within the EDA sector and its potential impact on key players like SK Hynix and Samsung. Following the acquisition, it’s plausible that Samsung, which began utilizing EDA products from Empyrean and Primarius in 2022, might reconsider its partnerships based on the evolving regulatory landscape.

Both Empyrean and Primarius boast a comprehensive range of EDA tools, with Empyrean providing a complete suite for analog circuit design, while Primarius specializes in manufacturing EDA tools, including device modeling and circuit simulation. The adaptation of these tools by major clients like Samsung and SK Hynix signifies a growing recognition of the capabilities of Chinese EDA entities.

The potential withdrawal of heavyweight manufacturers like SK Hynix and Samsung from employing Chinese EDA tools would undoubtedly exert pressure on the domestic firms. However, while the ramifications could have a negative impact, the extent might be constrained due to the domestic market reliance of these EDA suppliers. Reports indicate that approximately 90% of Empyrean's revenue came from the Chinese market, underscoring the importance of local business in maintaining their viability.

Furthermore, even if SK Hynix and Samsung cease utilizing Chinese EDA tools for chip design, it's unlikely that partnerships in foundry services would be terminated. These collaborations are critical, as they support wafer foundry clients using local EDA solutions for manufacturing processes. Discontinuing such support could lead to a loss of essential clients, thereby impacting the overall market landscape.

On the financial front, if SK Hynix and Samsung pivot towards exclusive use of American EDA tools, this would heighten their dependence on U.S. suppliers, thereby inflating their chip design costs significantly, since American EDA tools can cost upwards of twice the price of their Chinese counterparts. Consequently, transitioning fully to U.S. solutions, while outright abandoning more cost-efficient Chinese alternatives, is likely to lead to increased pressures on operational budgets for Korean firms.

It is worth mentioning that the South Korean government is also investing in the growth of local EDA firms like Baum and Alsemy. This follows a strategic direction aiming to diminish reliance on external suppliers, a movement that might gain momentum in the context of global trade tensions.

As for the ongoing discussions regarding the use of Chinese EDA tools, an official from SK Hynix remarked, "We are currently assessing whether to continue with Chinese EDA solutions, as the timing for contract renewal is upon us." This statement reflects a broader trend of caution and strategic reevaluation in an industry deeply influenced by international relations and regulatory environments.

Post Comment