The Fall of Lithium-ion Batteries from Grace!

Advertisements

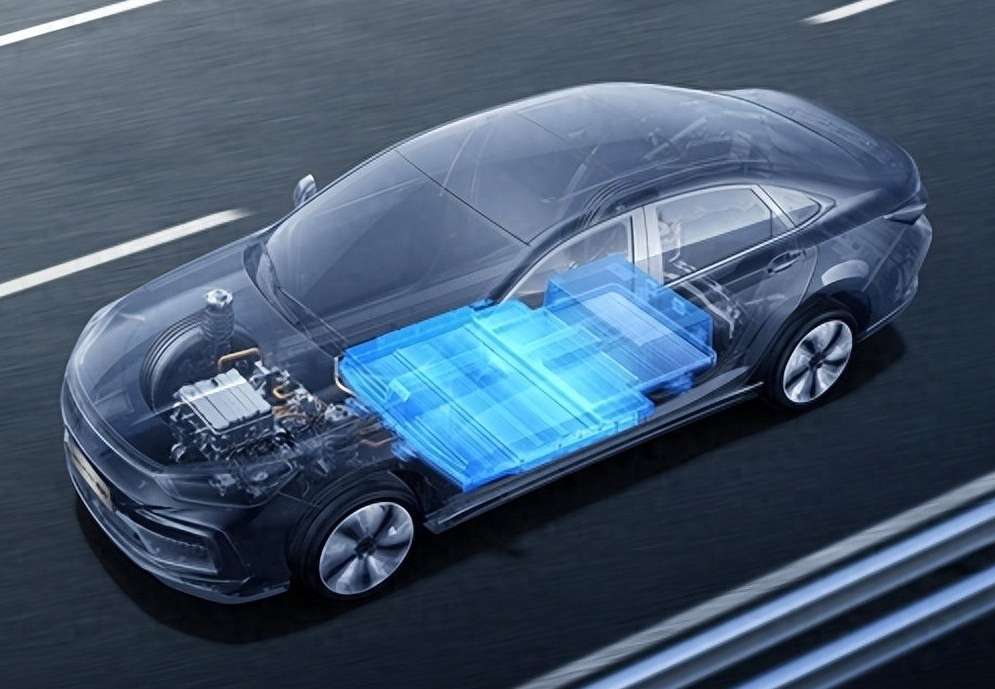

In recent years, the realm of electric vehicle (EV) technology has witnessed dramatic shifts, particularly regarding the types of lithium batteries that power these vehicles. At the forefront of this transformation is the ternary lithium battery, which utilizes combinations of nickel, cobalt, and manganese or nickel, cobalt, and aluminum in its cathode material. Historically, these batteries were lauded for their superior energy density, enabling longer driving ranges and enhanced performance, characteristics that made them immensely popular in the marketplace. However, recent trends indicate a reversal of fortune for ternary lithium batteries as the automotive industry pivots to alternative solutions.

Market data from Blue Whale News has highlighted a significant decline in the adoption of ternary lithium batteries in the passenger vehicle sector, with installation rates plummeting from 48% in December 2021 to a mere 25% by December 2024. In fact, during the latter month, the market share for ternary lithium batteries dropped below 20%. This stark contrast is accompanied by a rise in the market share for their competitor, lithium iron phosphate (LFP) batteries, which surged from 52% to an impressive 75% in the same timeframe.

Industry insiders attribute this shifting landscape primarily to a price war among electric vehicle manufacturers, which commenced in 2023. As one marketing executive from a leading lithium battery manufacturer pointed out, the competition has compelled upstream suppliers to cut costs. Given that the battery contributes significantly to the overall cost of electric vehicles, the economic advantages increasingly favor LFP batteries over the more expensive ternary lithium options. This evolving scenario illustrates the changing dynamics of supply and demand across the electric vehicle battery market.

Taking the case of CATL (Contemporary Amperex Technology Co. Limited), which predominantly championed ternary lithium technology, the company has begun a significant marketing push for LFP batteries as of 2024. Their promotional efforts center around the introduction of the 173Ah VDA specification LFP cell, reflecting a strategic pivot to align with market trends. According to data released by the China Automotive Power Battery Industry Innovation Alliance, LFP battery installations reached 139.7 GWh in 2024, marking a resurgence for CATL in terms of domestic market share.

The decline in ternary lithium battery adoption is also closely linked to the elimination of government subsidies for new energy vehicles. Previously, subsidies were linked to the energy density of the installed power batteries, creating a powerful incentive for manufacturers to favor higher-energy-density batteries like ternary lithium, which, despite their higher costs, were preferred due to the financial benefits tied to their enhanced performance. When subsidies were in place, vehicles with energy densities ranging from 105-120Wh/kg received 0.6 times the subsidy, while those exceeding 160Wh/kg could obtain a subsidy of 1.2 times. However, with the removal of these financial supports since that period, the primary concern for car manufacturers has shifted toward cost control, thereby amplifying the appeal of LFP batteries.

The technological advancements achieved by LFP batteries have also played a crucial role in their increasing market share. While ternary lithium batteries once held a substantial edge in terms of energy density, recent innovations have allowed LFP technology to catch up, effectively neutralizing previous disadvantages. Improvements in winter performance, addressing issues like "battery drop" in cold conditions, and the ability to support ultra-fast charging at 4C rates have also strengthened the position of LFP batteries in the marketplace.

From a consumer perspective, the allure of a more affordable electric vehicle with sufficient range trumps the higher cost of a vehicle that offers longer range. This aligns with the goals of most consumers seeking value for money in their purchases. Despite the waning popularity of ternary lithium technology, many industry experts emphasize that it remains a significant chemical system for lithium batteries. These batteries still feature prominently in high-end electric vehicles and will likely continue to have application scenarios, suggesting a long-term potential for growth in specific niches.

Various stakeholders in the battery manufacturing sector have expressed keen awareness of shifting demand. For example, a representative from a leading cathode material producer noted the remarkable ascent of LFP business and its corresponding impact on ternary material market share. The future trajectory of ternary materials hinges on technological innovation and breakthroughs in production cost reduction. The company is actively pursuing avenues to enhance material performance through innovation, striving to create competitive products within a challenging market landscape.

Additionally, discussions surrounding new battery technologies are emerging. Executives from a prominent battery company have hinted at the development of a new battery material that potentially eliminates the use of cobalt and significantly reduces nickel consumption. Similarly, insights from sources close to CATL reveal ongoing research into novel ternary lithium technologies aimed at optimizing production processes and supply chain management. These efforts are aimed at reducing both the cost of raw materials and the technical barriers associated with manufacturing ternary lithium batteries, indicating that while this type of battery may be facing challenges, there is still dedicated investment in improving its viability.

Looking ahead, numerous experts anticipate that energy storage technology will evolve towards solid-state or sodium-based batteries, making it increasingly improbable for one type of material to dominate the market moving forward. This projection aligns with the views of other industry insiders who maintain that, despite the longstanding establishment of the LFP + graphite system, the inclusion of innovative materials such as manganese and silicon in positive and negative electrodes suggests that the chemical systems in play are rapidly evolving. In the short term, they argue, it seems unlikely for any product to surpass the market share currently held by LFP batteries.

Post Comment